How AI-Powered Trading Signals Can Transform Your Trading Performance

AI-powered trading signals are revolutionising how traders identify opportunities and manage risk. Learn how trading-signals.co leverages machine learning, multi-timeframe analysis, and real-time data to generate high-probability trade setups for stocks, forex, and crypto—potentially transforming your trading strategy.

How AI-Powered Trading Signals Can Transform Your Trading Performance

In today's fast-paced financial markets, successful trading requires processing vast amounts of data, analyzing multiple timeframes, and quickly identifying high-probability setups. For many traders, this overwhelming task leads to missed opportunities, emotional decision-making, and inconsistent results.

This is where AI-powered trading signals platforms like trading-signals.co are making a significant impact. By leveraging advanced algorithms, machine learning, and real-time market data, these platforms are revolutionizing how traders approach the markets.

What Are AI-Powered Trading Signals?

AI-powered trading signals are systematically generated trade recommendations produced through the analysis of financial data using artificial intelligence and machine learning algorithms. Unlike traditional signal providers that rely solely on human analysis, platforms like trading-signals.co combine multiple data sources, technical indicators, and market context to identify potential opportunities.

The platform conducts daily analysis across multiple asset classes, including:

- Stocks

- Forex pairs

- Cryptocurrencies

- Market indices

Each signal provides specific entry points, stop-loss levels, take-profit targets, and a confidence score based on multiple factors across different timeframes.

The Technology Behind trading-signals.co

What sets trading-signals.co apart is its sophisticated technology stack and data processing capabilities. Built on a modern architecture that includes Next.js, Node.js, and a serverless PostgreSQL database, the platform ensures reliable, real-time signal generation.

Core Components

-

Data Collection Engine

- Integrates with multiple financial APIs (Alpha Vantage, Polygon.io)

- Implements automated daily data retrieval

- Employs robust error handling with fallback mechanisms

-

AI Analysis System

- Utilizes machine learning for stock prediction

- Enhances trade setup generation with GPT-4

- Scores trade opportunities using probabilistic models

-

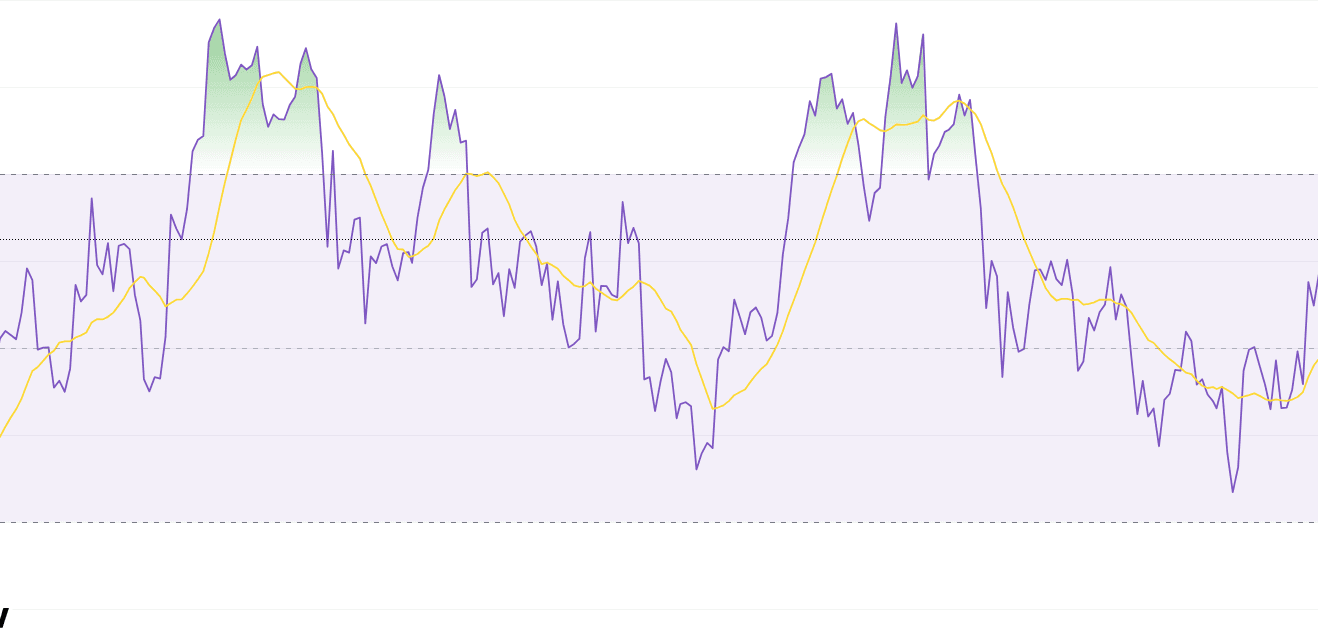

Multi-Timeframe Analysis

- Analyzes 15-minute, 1-hour, 4-hour, and daily timeframes

- Ensures trend alignment across different time periods

- Identifies support/resistance levels, momentum shifts, and divergences

-

Technical Indicator Suite

- Calculates multiple indicators including:

- Moving averages (SMA, EMA, WMA)

- Momentum indicators (RSI, MACD, Stochastic)

- Volatility measurements (Bollinger Bands, ATR)

- Volume analysis (OBV, Volume Profile)

- Calculates multiple indicators including:

-

Interactive Visualization

- Presents data through TradingView-style charts

- Displays trade setup details

Key Benefits for Traders

1. Data-Driven Decision Making

Perhaps the most significant advantage of using AI-powered trading signals is the shift from emotional to data-driven decision-making. The platform processes more information than any individual could manually analyze, leading to more objective trade setups.

2. Comprehensive Market Coverage

While individual traders typically focus on a handful of assets, trading-signals.co monitors hundreds of potential opportunities across multiple markets. This expanded coverage helps traders discover setups they might otherwise miss.

3. Time Efficiency

Professional trading requires hours of chart analysis, news monitoring, and pattern recognition. The automated nature of trading-signals.co frees up this time, allowing traders to focus on execution, strategy refinement, and education.

4. Multi-Timeframe Confirmation

One of the most powerful features is the platform's ability to analyze multiple timeframes simultaneously. This approach helps identify high-probability setups where directional bias is confirmed across different time perspectives, potentially reducing false signals.

5. Risk Management Integration

Each signal comes with predefined risk parameters, including:

- Precise entry points

- Strategic stop-loss placement

- Realistic profit targets

- Risk-to-reward calculations

This structured approach encourages disciplined trading and consistent position sizing.

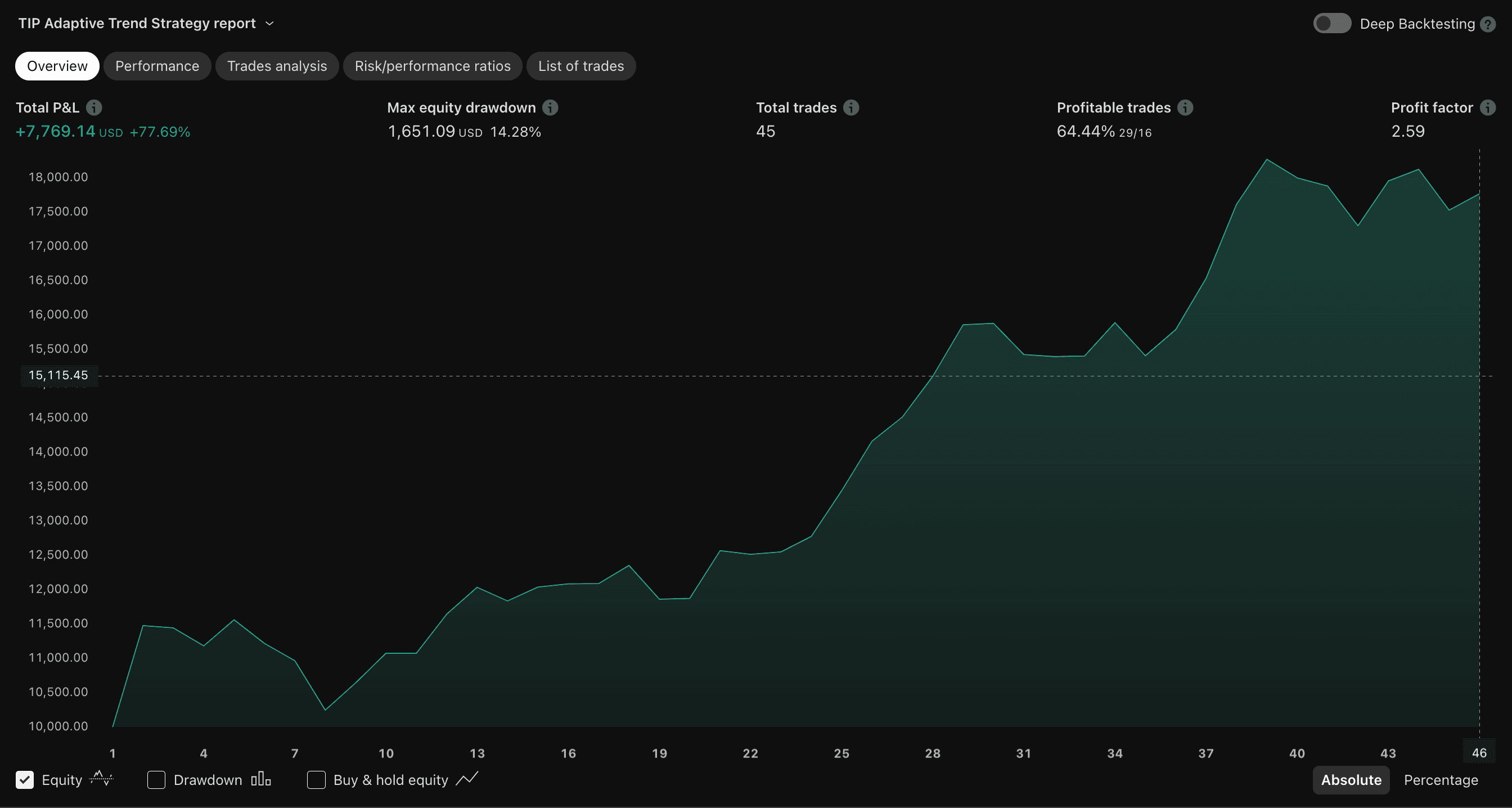

Real-World Performance

While past performance doesn't guarantee future results, the platform demonstrates impressive statistics:

| Metric | Basic Plan | Premium Plan |

|---|---|---|

| Average R:R Ratio | 1:2.1 | 1:2.8 |

| Signals Per Week | 15-25 | 30-50 |

| Daily Updates | Yes | Yes |

| Multi-Timeframe | Limited | Full |

| Market Coverage | Stocks Only | Stocks, Forex, Crypto |

Subscription Options

Trading-signals.co offers multiple subscription tiers to accommodate different trader needs:

Free Tier

- 1 signal per day

- Access to stock signals only

- Basic technical analysis

Basic Plan ($49.99/month)

- 3 signals per day

- Stocks and forex signals

- Recent signal history (7 days)

- Email alerts

Premium Plan ($59.99/month)

- 15+ signals per day

- Full market coverage (stocks, forex, crypto)

- Complete historical signal database

- Advanced filtering

- Custom alerts

- Priority support

Integration With Your Trading Strategy

It's important to note that trading-signals.co is designed to complement, not replace, your trading strategy. The platform works best when used as part of a comprehensive approach that includes:

- Personal Validation - Reviewing signals against your own analysis

- Risk Management - Adjusting position sizes based on your risk tolerance

- Market Context - Considering broader market conditions

- Portfolio Diversification - Using signals across different asset classes

Getting Started

Setting up and using trading-signals.co involves a straightforward process:

- Sign up for an account at trading-signals.co

- Select your subscription tier

- Review daily signals through the dashboard

- Track performance and adjust your approach as needed

Common Questions About Trading Signals

Are these signals guaranteed to be profitable?

No trading system or signal service can guarantee profits. While trading-signals.co uses sophisticated algorithms to identify high-probability setups, all trading involves risk. The platform's value comes from its systematic approach and data-driven analysis, which can help improve decision-making.

How much capital do I need to use these signals?

The platform is designed to accommodate traders with various account sizes. Position sizing should always be based on your risk management principles. The system provides R:R (risk-to-reward) ratios that can be adapted to different account sizes.

Do I need to be an experienced trader to use the platform?

While the platform is user-friendly, having a basic understanding of trading concepts, technical analysis, and risk management is recommended. More experienced traders often get the most value by integrating signals into their existing strategies.

How quickly do I need to act on signals?

Most signals remain valid for 24-48 hours after generation, though market conditions can change rapidly. The platform provides timelines for each setup, indicating optimal execution windows.

Conclusion

In an increasingly complex trading environment, AI-powered trading signals offer a compelling advantage for traders seeking to make more informed, data-driven decisions. Platforms like trading-signals.co leverage advanced technology to process vast amounts of market data, identify high-probability setups, and deliver actionable insights.

Whether you're a day trader looking for short-term opportunities or a swing trader focused on larger moves, integrating AI-generated signals can potentially enhance your trading performance while saving valuable time and reducing emotional decision-making.

Ready to transform your trading with AI-powered signals? Visit trading-signals.co to explore subscription options and experience the difference that systematic, data-driven trading signals can make.