Automating Your Trading: A Complete Guide to TradingView, Make.com, Wundertrading and Binance Integration

Learn how to create a powerful automated trading system by integrating TradingView strategies with Binance using Make.com and Wundertrading. This comprehensive guide walks you through setting up a seamless workflow that executes your trading strategies 24/7, removes emotional decision-making, and helps maximize your trading efficiency.

In today's fast-paced trading environment, automation has become essential for traders looking to maintain consistency, remove emotional decision-making, and execute strategies 24/7. This comprehensive guide will walk you through creating a powerful automated trading system by integrating TradingView strategies with Binance using Make.com and Wundertrading as the connecting bridges.

Whether you're a day trader wanting to execute your trades more efficiently or a long-term investor looking to automate your portfolio management, this step-by-step guide will help you create a seamless automated trading workflow that works while you sleep.

What You'll Learn

- How TradingView strategies work and why they're powerful for traders

- Setting up Wundertrading to connect your TradingView signals to Binance

- Creating flexible automation workflows with Make.com

- Implementing risk management in your automated trading system

- Advanced configuration options to customize your trading experience

Prerequisites

- A TradingView account (preferably Pro for custom alerts)

- A Binance account with API access enabled

- A Make.com account (formerly Integromat)

- A Wundertrading account

- Basic understanding of trading concepts

Why Automate Your Trading?

Before diving into the technical setup, let's understand why automating your trading with these tools offers significant advantages:

- Emotion-Free Trading: Automated systems execute based on pre-defined rules, eliminating fear and greed from your trading.

- 24/7 Market Monitoring: Your automated system works even when you're sleeping or away from your computer.

- Consistency: Ensures your strategy is applied consistently across all trading conditions.

- Backtesting Capabilities: TradingView allows you to test your strategies against historical data before risking real capital.

- Diversification: Automation makes it feasible to manage multiple strategies across different markets simultaneously.

Part 1: Understanding TradingView Strategies

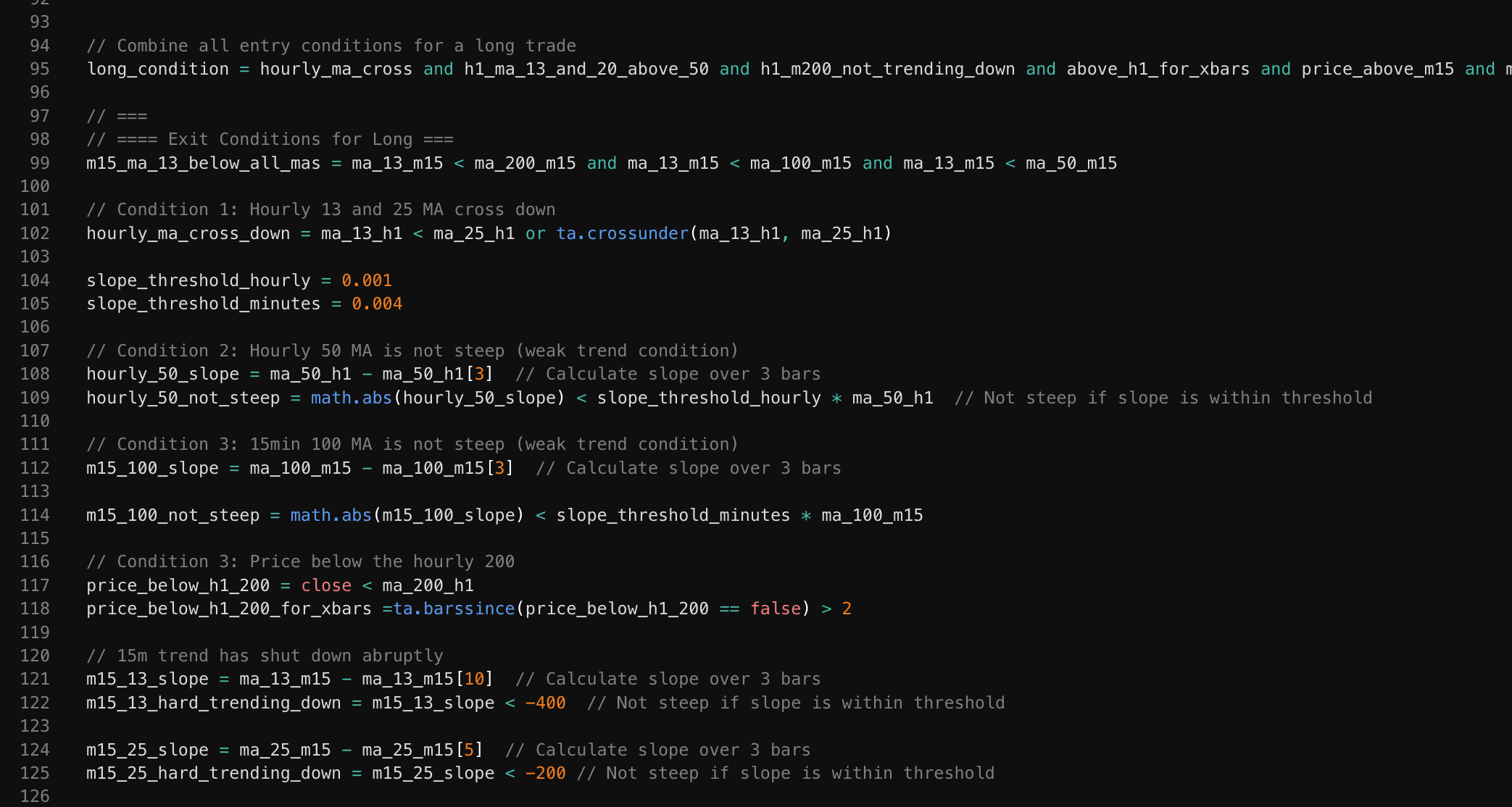

TradingView strategies are scripts written in Pine Script that define the conditions for entering and exiting trades. These strategies can be backtested against historical data and set up to generate alerts when trading conditions are met.

Components of a TradingView Strategy

A typical TradingView strategy consists of:

- Entry Conditions: The technical indicators or price action patterns that signal when to enter a trade

- Exit Conditions: The rules determining when to exit a profitable trade or cut losses

- Position Sizing: Rules for determining how much to invest in each trade

- Risk Management: Stop-loss and take-profit levels

Creating Alert Conditions

For your automation to work, you'll need to set up alerts in TradingView that trigger when your strategy generates signals. Here's how:

- Open your TradingView chart with your strategy applied

- Right-click on the chart and select "Add Alert"

- Configure the alert to trigger based on your strategy's signals

- Set the alert to "Once Per Bar Close" for most reliable results

- In the "Notification" section, select "Webhook URL"

- Save the webhook URL from Wundertrading or Make.com (we'll get this in later steps)

Important: The format of your alert message is crucial as it will determine how your automation interprets the signal. Here's a recommended format:

{

"strategy": "Your Strategy Name",

"symbol": "{{ticker}}",

"action": "{{strategy.order.action}}",

"price": {{close}},

"quantity": "{{strategy.order.contracts}}",

"time": "{{time}}"

}Part 2: Setting Up Wundertrading

Wundertrading is a platform that connects TradingView alerts directly to cryptocurrency exchanges like Binance. It offers a straightforward way to execute trades based on your TradingView signals.

Creating a Wundertrading Account

- Go to Wundertrading.com and sign up

- Complete the verification process if required

- Navigate to the "Exchanges" section and connect your Binance account:

- Click "Add Exchange"

- Select "Binance"

- Enter your Binance API key and secret

- Set appropriate permissions (read and trade, but not withdrawal)

Configuring a TradingView Bot in Wundertrading

- Go to the "Bots" section and click "Create Bot"

- Select "TradingView Signals"

- Configure your bot settings:

- Name your bot

- Select the connected Binance account

- Choose the trading pair (e.g., BTC/USDT)

- Set your risk parameters (position size, stop-loss, take-profit)

- Obtain your webhook URL from the bot settings

- Copy this URL to use in your TradingView alert

Testing Your Wundertrading Setup

Before going live, it's essential to test your setup:

- Create a test alert in TradingView with a small position size

- Trigger the alert manually

- Check the Wundertrading logs to confirm the signal was received

- Verify that the test order was placed correctly on Binance

Part 3: Enhancing Your Setup with Make.com

While Wundertrading provides a direct connection between TradingView and Binance, Make.com (formerly Integromat) offers more flexibility and advanced features for your automation.

Why Use Make.com?

Make.com allows you to:

- Process and filter trading signals before execution

- Implement more complex risk management rules

- Connect multiple platforms and services

- Send notifications through various channels

- Create detailed logs of your trading activities

- Implement conditional logic based on market conditions

Setting Up Make.com

- Create an account at Make.com

- Click "Create a new scenario"

- Start with a webhook trigger:

- Add a "Webhooks" module as your trigger

- Select "Custom webhook"

- Copy the provided webhook URL

- Use this URL in your TradingView alert settings

Creating a Basic TradingView to Binance Scenario

Here's a step-by-step guide to creating a basic scenario in Make.com:

- Set up the trigger: Configure the webhook to receive TradingView alerts

- Parse the data: Add a "JSON Parse" module to extract information from the alert

- Add conditional routing: Use a "Router" module to handle different types of signals (buy, sell, etc.)

- Connect to Binance: Add a "Binance" module and configure it with your API credentials

- Execute the trade: Configure the Binance module to place the appropriate order based on the signal

- Add notification: Include an email or other notification to keep you informed

Advanced Make.com Features for Trading

To take your automation to the next level, consider these advanced Make.com features:

- Market Condition Filters: Add modules to check broader market conditions before executing trades

- Position Sizing Calculations: Implement dynamic position sizing based on account balance and volatility

- Multi-Exchange Execution: Route orders to different exchanges based on liquidity and fees

- Trading Journal Integration: Automatically log all trades to a spreadsheet or database

- Performance Analytics: Calculate and track your strategy's performance metrics

Part 4: Integrating Make.com with Wundertrading

For ultimate flexibility, you can combine Make.com and Wundertrading in your setup:

Option 1: TradingView → Make.com → Wundertrading → Binance

In this configuration:

- TradingView sends signals to Make.com

- Make.com processes and filters the signals

- Make.com forwards qualified signals to Wundertrading

- Wundertrading executes the trades on Binance

Option 2: TradingView → Make.com → Binance (Direct)

Alternatively:

- TradingView sends signals to Make.com

- Make.com processes the signals

- Make.com executes trades directly on Binance using the Binance module

Setting Up the Integration

To connect Make.com with Wundertrading:

- In Make.com, after processing your signal, add an "HTTP" module

- Configure it to make a POST request to your Wundertrading webhook URL

- Format the data according to Wundertrading's requirements:

{

"signal": "buy",

"pair": "{{1.symbol}}",

"price": "{{1.price}}",

"volume": "{{calculatePositionSize}}"

}Part 5: Risk Management and Best Practices

No automated trading system is complete without robust risk management:

Essential Risk Management Features

- Position Sizing: Never risk more than 1-2% of your portfolio on a single trade

- Stop-Loss Orders: Always include stop-loss orders to protect against significant drawdowns

- Take-Profit Levels: Define clear profit targets for your strategies

- Circuit Breakers: Implement system-wide circuit breakers that pause trading after consecutive losses

- Diversification: Run multiple uncorrelated strategies to reduce overall risk

Monitoring and Maintenance

Regular monitoring is essential:

- Set up daily performance reports via email

- Create alerts for unusual behavior or technical issues

- Periodically review and optimize your strategies

- Keep logs of all system actions for troubleshooting

- Have a manual override procedure for emergency situations

Conclusion

Integrating TradingView with Binance through Make.com and Wundertrading creates a powerful, flexible automated trading system that can execute your strategies with precision and consistency. This setup allows you to leverage the analytical power of TradingView, the execution capabilities of Binance, and the automation flexibility of Make.com and Wundertrading.

Remember that even the best automated system requires oversight and periodic adjustments. Markets evolve, and your automation should evolve with them. Regular backtesting, optimization, and risk management reviews are essential components of a successful automated trading operation.

By following this guide, you've taken an important step toward more disciplined, systematic trading that removes emotional biases and allows you to scale your trading activities efficiently.