Automating Crypto Trades: A Beginner's Guide to Make.com and Kraken Integration

The world of cryptocurrency trading can be overwhelming, especially for beginners. What if you could automate your trading strategies without deep programming knowledge? This comprehensive guide will walk you through creating an automated trading system using Make.com and Kraken, transforming your trading approach with powerful yet accessible automation tools.

Automating Crypto Trades: A Beginner's Guide to Make.com and Kraken Integration

The world of cryptocurrency trading can be overwhelming, especially for beginners. What if you could automate your trading strategies without deep programming knowledge? This comprehensive guide will walk you through creating an automated trading system using Make.com and Kraken, transforming your trading approach with powerful yet accessible automation tools.

Understanding the Automation Ecosystem

Before diving into the technical details, let's break down the key components of our trading automation strategy:

- Make.com (formerly Integromat): A no-code automation platform that allows you to create complex workflows between different services

- Kraken: A popular cryptocurrency exchange known for its robust API and advanced trading features

- Trading Strategies: Automated rules for entering and exiting trades based on specific market conditions

Prerequisites and Preparation

Tools You'll Need

- Kraken Account

- Create an account at kraken.com

- Complete full verification for increased trading limits

- Enable two-factor authentication (2FA)

- Make.com Account

- Sign up at make.com

- Choose a plan with sufficient operations and API integrations

- Familiarize yourself with the visual workflow interface

- Additional Recommended Tools

- TradingView (for strategy development)

- Spreadsheet software for tracking

- Secure password manager

Detailed Setup Guide

Part 1: Kraken API Configuration

Securely connecting Kraken to your automated trading requires careful API management.

- Generate Kraken API Keys

- Log into Kraken account

- Navigate to Security > API

- Click "Generate New Key"

- Set API Permissions:

- Query Funds ✓

- Query Open Orders ✓

- Create & Modify Orders ✓

- Withdraw Funds ✗ (Keep this disabled for safety)

- Whitelist IP addresses for additional security

- Save API Key and Private Key (store securely)

- API Security Best Practices

- Use a dedicated API key for automation

- Never share your Private Key

- Regularly rotate API keys

- Monitor API activity for suspicious transactions

Part 2: Make.com Automation Workflow

Creating a robust automation workflow that connects your trading strategy to Kraken.

- Create Automation Scenario in Make.com

- Click "Create a new scenario"

- Recommended Module Sequence:

- Trigger Module (Webhook/Scheduler)

- Kraken API Modules

- Logging Module

- Notification Module

- Example Trading Automation Workflow

// Basic Trading Automation Logic Pseudocode function analyzeTradingConditions() { // Fetch current market data let marketPrice = fetchCurrentPrice('BTC/USDT'); let technicalIndicators = calculateTechnicalIndicators(); // Define entry conditions if (technicalIndicators.rsi < 30 && marketPrice < movingAverages.shortTerm) { return { action: 'BUY', symbol: 'BTCUSDT', quantity: calculatePositionSize(), type: 'MARKET' }; } // Define exit conditions if (technicalIndicators.rsi > 70 || hasStopLossTriggered()) { return { action: 'SELL', symbol: 'BTCUSDT', quantity: 'ALL' }; } return null; // No action } - Webhook Configuration

- Add HTTP Webhook module in Make.com

- Generate a unique webhook URL

- Configure payload structure for trade signals

- Kraken Trade Execution Module

- Connect Kraken API credentials

- Map webhook payload to Kraken trade parameters

- Implement trade validation logic

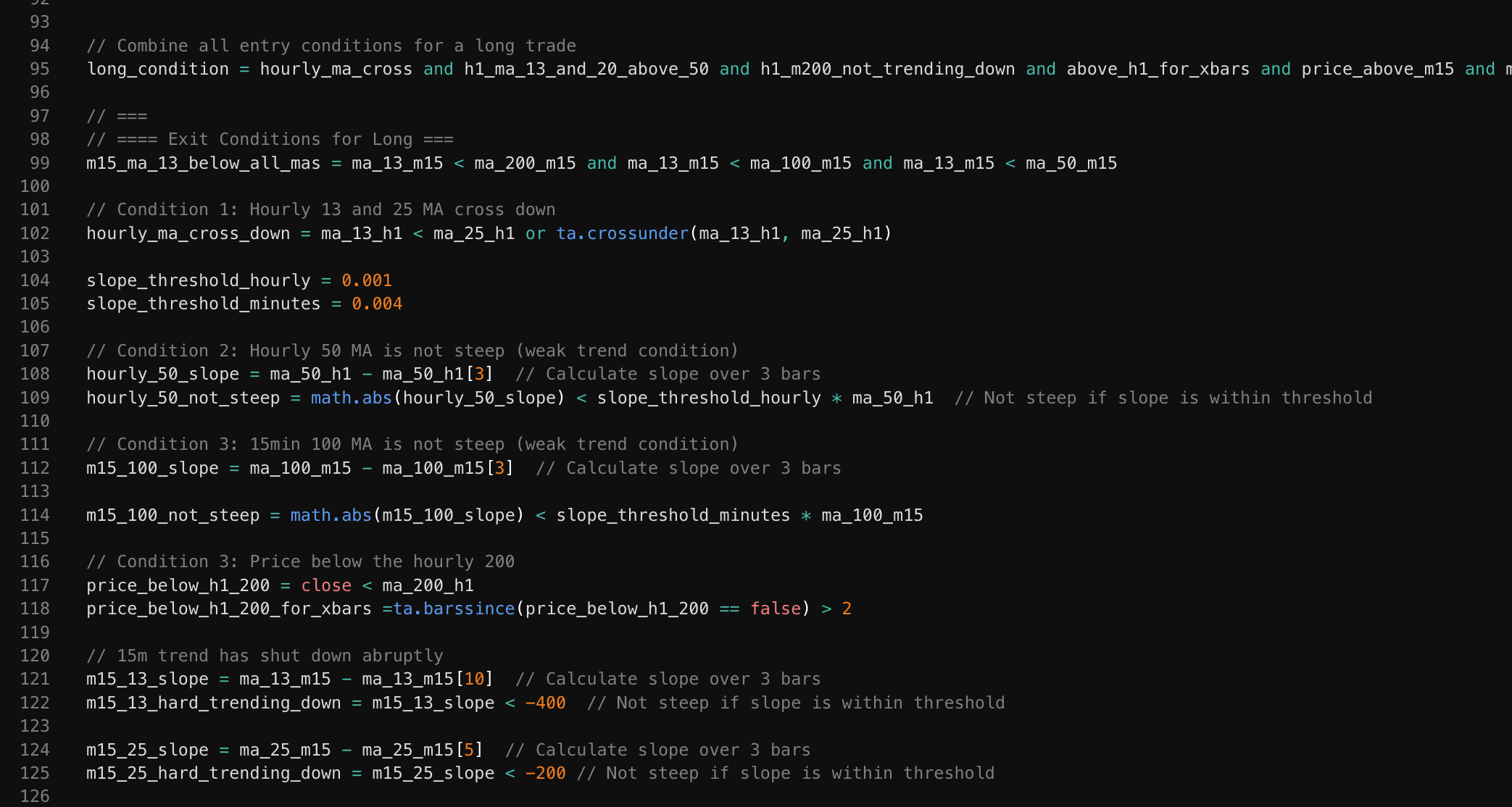

Part 3: Advanced Trading Strategies

Moving beyond basic automation to create intelligent trading workflows.

Strategy Components

- Technical Indicators

Leverage indicators like RSI, Moving Averages, and MACD to create smart entry and exit points.

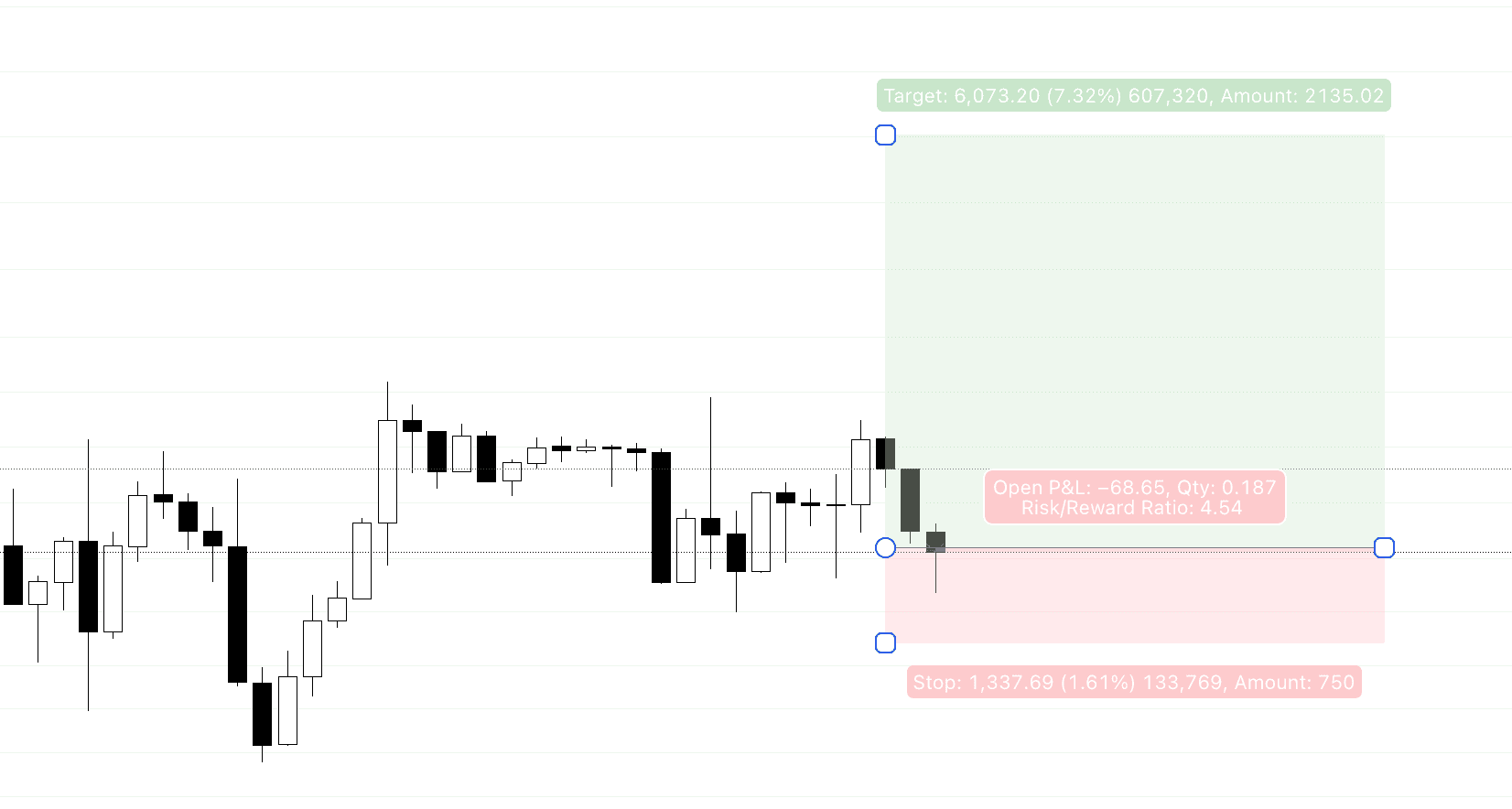

- Risk Management

Implement robust risk controls:

- Position sizing (never risk more than 1-2% per trade)

- Automatic stop-loss orders

- Take-profit level configuration

Monitoring and Optimization

Performance Tracking

- Set up real-time trade logging in Make.com

- Create notification integrations (Slack, Email)

- Develop a spreadsheet for comprehensive performance tracking

Common Pitfalls to Avoid

- Over-complicating trading strategies

- Ignoring transaction fees

- Neglecting regular strategy reviews

- Trading without understanding market dynamics

Continuous Learning and Adaptation

Automated trading is an evolving skill. Key principles:

- Start with small position sizes

- Backtest strategies extensively

- Continuously educate yourself

- Be prepared to adapt to changing market conditions

Disclaimer

Cryptocurrency trading involves significant financial risk. This guide is for educational purposes only. Always conduct thorough research, start with small amounts, and consider consulting a financial advisor before making investment decisions.